New Zealand: Currently ranking sixth among major global markets for IPOs?

I just read a story in the Asian WSJ (New Zealand’s Privatization Effort Propels IPO Market) which totally took me surprise… little New Zealand with its population of only 4.5 million people, “this year ranks among major global markets for initial public offerings (IPOs), thanks to a government privatization drive that has put the stock exchange on pace for one of its best-ever years for IPOs by value.”

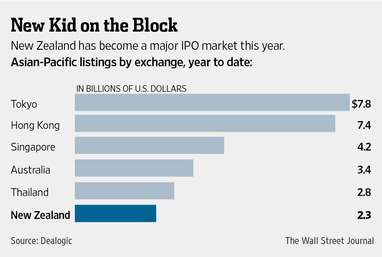

So far this year, the NZX Ltd. has hosted a total of US$2.3 billion of IPOs, nearly double the $1.3 billion raised over the previous six years combined, according to data provider Dealogic. That has catapulted it into sixth place among the Asian-Pacific region’s top IPO markets—behind Japan, Hong Kong, Singapore, Australia and Thailand—and puts it in 14th place world-wide.

Furthermore according to the Asian WSJ “the benchmark NZX-50 share index hit an all-time high last week and is the second-best performer in the region this year, behind only Japan’s Nikkei Stock Average.”

Analysts who note that the NZX-50 gained 16% this year add that “New Zealand has growth fundamentals that a lot of countries would like to have.” This has no doubt “further underpinned consumer confidence.”

According to the Asia WSJ”

“The privatization program driving the new listings is intended to help restore the government’s budget to a surplus in the fiscal year through June 2015, ending five years of deficits, by raising around five billion New Zealand dollars (NZ$4.2 billion). The government has already raised NZ$1.7 billion from the sale of a 49% stake in electricity generator Mighty River Power Ltd… On Friday, government officials revealed details of the biggest sale of a state-owned asset in the country’s history—the IPO of Meridian Energy Ltd. The government wants to sell 49% of the company, which supplies electricity to households and businesses, and estimates the stake to be worth at least US$1.6 billion. The targeted listing date is Oct. 29.“

“It also plans to sell 49% of Genesis Energy Ltd. and 23% of listed flag carrier Air New Zealand Ltd. The Air New Zealand stake is valued at about NZ$350 million and might be sold later this year. The Genesis Energy offering, likely to raise around NZ$1 billion, is expected early next year.”

So how is this impacting neighbouring Australia?

“The new life in New Zealand’s IPO market is giving a helping hand to the Australian Securities Exchange, where listings of domestic companies have stagnated. Mighty River Power and New Zealand fuel retailer and refiner Z Energy Ltd., which raised US$677 million in an IPO last month, were also listed on the ASX. The New Zealand government also plans a secondary listing in Australia for Meridian.”

Furthermore “expectations that the New Zealand dollar will rise against the Australian dollar have kindled interest in the IPOs among Australian fund managers looking to place bets on swings in the currencies.”

Related articles

- New Zealand’s Privatization Effort Propels Country’s IPO Market (blogs.wsj.com)

- No early Air NZ sale – Key (stuff.co.nz)

- New Zealand announces details of power company IPO (kansascity.com)

- Meridian float gets go ahead (stuff.co.nz)

- What is an IPO? (rasmussen.edu)

- New Zealand Targets About NZ$2 Billion From Meridian Share Sale – Bloomberg (bloomberg.com)

- New Zealand to raise up to $1.8 billion from IPO (sfgate.com)

- NZX to publish Meridian research reports (nzherald.co.nz)

- New Zealand to Raise Up to $1.8 billion from Power Company IPO (dailyfinance.com)

- NZX to rebalance its Top 20 index (radionz.co.nz)